|

Why Are Utah Republican

Legislators and the Utah Taxpayers Association Supporting

Harmful Tax Increases?

By Emily Sedgwick

Under the auspices

of "streamlining," Utah has enacted

a bill to extort businesses, destroy its small business-based

economy, and stab fiscal responsibility and state sovereignty

in the back.

During the 2003 session, the legislature passed Senate Bill

147S1, "Streamlined Sales Tax Project Amendments." This

208-page, complex bill drastically alters Utah’s sales tax

laws and brings Utah under the multi-state Streamlined Sales

Tax Project (SSTP). It specifically targeted out-of-state

catalog and Internet sales, and, according to the Utah State

Tax Commission, was supposed to raise taxes by $130 million

each year.

Streamlining taxes is a catchy ploy. SSTP does, in fact,

contain provisions to improve tax system efficiency and reduce

audits for businesses. But the devil is easily seen in the

details, including provisions and definitions that will, in

all likelihood, reduce competition and sovereignty among local

and state tax jurisdictions and increase taxes.

In the battle to limit taxes and spending, definitions are a

big deal, and the way those definitions are formed and

enforced are an even bigger deal.

Take the Multistate Tax Commission (MTC), for example,

currently comprised of 44 states and the District of Columbia

ranging from active members to observers. MTC organizes

conferences throughout the year to formulate SSTP tax code

definitions.

In Indianapolis, Indiana in April 2003 an MTC group of 150

state revenue bureaucrats, lawmakers, and businesses discussed

the tax implications of defining a "bundled transaction," and

whether various changes would tax services that currently are

not taxed.

Another discussion arose regarding a uniform definition for

"television services" to include cable, satellite, and dish

providers – a situation in which a crafty definition could

increase taxes. North Carolina officials are already

salivating, and plan to impose a de facto tax increase

on postage in certain cases by changing business service

definitions.

Can anyone seriously argue that cash-strapped states will not

use these "simplified" definitions to raise taxes? States will

still choose to tax or exempt every service and sale, but will

codify each service and sale according to SSTP-approved

guidelines.

While states will reserve the right to levy different rates

against similarly defined products and services, they will be

pressured to levy taxes in similar fashion to higher-tax

states. States joining SSTP and adopting its recommendation

will seriously compromise their sovereignty with regard to

maintaining competitive tax code definitions of their own.

Big government advocates have claimed that SB 147 S1 is not a

tax at all – but rather a voluntary opportunity for businesses

to contribute more to state government coffers.

What they don’t talk about is SB 147 S1’s stipulation that

businesses that go along with the SSTP project now will not

incur liability for past failures to collect sales taxes when

STTP is fully functioning. In other words, these government

extortionists have implicitly warned businesses that if they

don’t pay their "voluntary" protection fees today, Guido will

rummage through their past records tomorrow – looking for

something to hang them with.

Indeed, the biggest losers of SB 147S1 and STTP will be

businesses – ever-vulnerable targets for sleight-of-hand

definition changes. American businesses already contribute

$378.9 billion in state and local taxes (2002) and 41.3% of

all tax collections. Smaller-sized businesses are most at

risk, because they do not have the staff or resources to lobby

for advantageous definitions at MTC planning meetings

(ironically, big government advocates claimed that SB 147S1

was necessary to "protect brick and mortar" establishments).

Which brings us back to Utah, already the ninth-highest taxed

state in the nation. Tax-and-spend Governor Michael O.

Leavitt, a long-time advocate of Internet taxes, has been

joined by the Republican-controlled legislature in passing SB

147S1. With 62 percent of Utah businesses operating with ten

employees or less, one would think that SB 147S1 would have

been resoundingly defeated.

The opposite occurred, however. Utah lawmakers appear blindly

determined to torpedo the fragile boat that feeds Utah

families and continues to float their unstable economy.

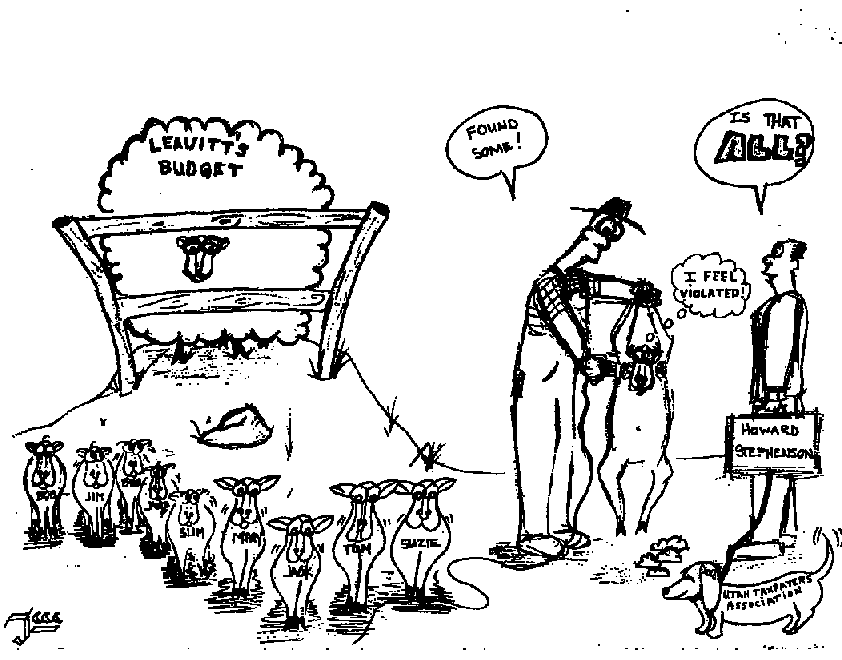

In addition, the Utah Taxpayers Association (UTA), purportedly

a voice against tax increases, actively lobbied for the bill’s

passage. UTA President Howard Stephenson, also a state senator

and a Taxpayer Protection Pledge signer, voted in favor of

this tax increase.

When the legislature was recently informed that revenue

estimates from SB 147S1 had dropped from $130 million to $30

million, Stephenson’s disappointed response was: "Is that

all?"

With leadership like this, who needs enemies?

* *

* * *

Accountability

Utah Note for Readers: Emily Sedgwick is State

Project Manager for Americans for Tax Reform (ATR), the

largest taxpayer advocate organization in America.

Grover Norquist, President of ATR, has Pres. Bush's attention

on taxes and is largely responsible for the success of the

latest federal tax cut.

From ATR's mission statement: "ATR

opposes all tax increases as a matter of principle. We

believe in a system in which taxes are simpler, fairer,

flatter, more visible, and lower than they are today. The

government’s power to control one’s life derives from its

power to tax. We believe that power should be minimized."

For more information on ATR, see

www.atr.org.

Permission to reprint this

article is hereby granted provided that the author,

Accountability Utah, and Americans for Tax Reform are cited.

See the

Taxes & Spending section of our Issues & Alerts page for

more information on Utah taxes, including the poor performance

of both parties on tax issues.

If you need help finding your legislator, visit our

elected official contact page.

Click on Accountability Utah's

cartoon below for an artist's rendition of the state of

affairs for Utah taxpayers.

If you have comments or suggestions, please

email us at info@accountabilityutah.org.

|